If you can save $250,000, Apple offers you a guaranteed income of $11,250 a year.

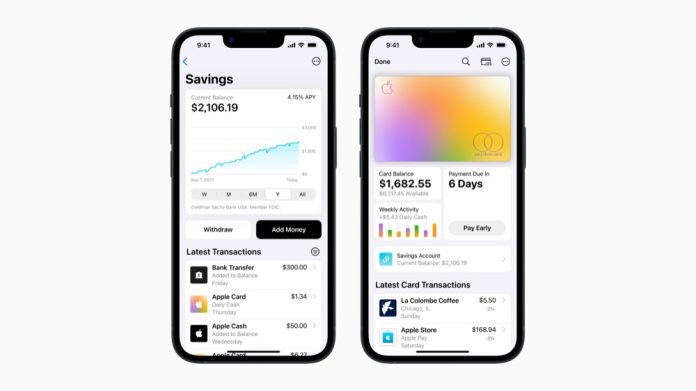

Apple’s high-yield savings account has already proven its worth, with nearly $1 billion in deposits stashed within the service in just four days. And the only way is up.

A billion in four days is a good start

You see, what many may have overlooked when the company launched the system is that the type of people it offered the high-yield savings service also meant it had instant access to the type of people who put cash aside could.

What’s up

That’s not because of an inherent class bias, but simply reflects three key metrics:

- Apple is offering a much higher interest rate than most savers currently enjoy in the US. That 4.5% rate is incredibly tempting for savers used to being offered under 1% elsewhere – it’s the kind of rate that more than justifies the hassle of moving money between accounts.

- The Savings Account is only available to existing Apple Card users. What that means is super simple – it means it’s made available to people with good credit ratings, which basically limits the audience to those who tend to have small disposable incomes. That means Apple and Goldman Sachs inherently offer people who have little money a better interest rate than they’ll find anywhere else. Of course they sign up.

- The essence of iPhone users. It’s not a universal rule, but it’s a well-known fact that iPhones are popular with wealthy individuals as well. These are the people who would pay for gold and jewelry encrusted iPhones. Why wouldn’t they put huge chunks of cash into an account that pays them 4.5%?

What’s new is that the latest news that Apple’s service has attracted $990 million in deposits in just four days confirms all three prepositions – these people will save with this account.

As word gets around, you should expect tens of millions more to be saved in the savings account, and that should also spark a new wave of Apple Card signups in the US. Reportedly, 240,000 savings accounts had been opened by the end of the introductory week.

who do you trust

There is a second context to think about.

We just saw the collapse of three US banks in the last few weeks. Banks compete to attract and hold deposits to support their businesses. The First Republic Bank, the latest collapse, recently lost $100 billion in deposits as people panicked after the earlier Silicon Valley Bank collapse.

Faced with this kind of uncertainty, savers will naturally divert their money to those offering the best interest rates, and this billion-dollar saving in Apple Savings in Week One logically should be just the beginning of this cash parade.

Apple has a magic money tree

This parade could also encourage additional use of the Apple Card, if only high-net-worth individuals start using the card to earn that good interest rate.

It also expands the potential market for using Apple’s new “Pay Later” service and could generate even more demand from non-US users looking to join the Apple Card in bulk.

The only limitation I can see is that the amount of cash each individual can put into these accounts is $250,000 — even though 1,000 of these big accounts are still $2.5 billion in savings made every year generate a massive $112.5 million in interest.

(And when you get such returns, may I please humbly remind you that my server fee fund is always desperate for support, and I’d appreciate any help you can offer while I await that inevitable lottery win that I always do nor reject accepting is not coming to me).

Can Apple’s money parade tempt people to save?

Thrivers, strivers and big wins in small numbers

I think so, and since the company’s wealthiest US customers understand the table stakes in this game, I wouldn’t be at all surprised if the amount of cash held in these accounts grows almost as fast as the iPhone’s market share.

And that will lead to an even higher level of Apple platform stickiness, translating into additional purchases of Macs and accessories, and means that even in what is currently an incredibly difficult economic market, Cupertino is building a bulwark of the world’s wealthiest to support the company Success to help hard times.

That’s pretty smart. And while the profits Apple makes from this side of its service offering may be tiny on some metrics, a tiny fraction of big numbers quickly becomes big. Now repeat it globally and watch the flip.

Please follow me on Mastodon or join me in the AppleHolic’s Bar & Grill and Apple Discussions groups on MeWe.

Dear reader, I just want to let you know that as an Amazon Associate, I earn from qualifying purchases.

www.applemust.com

https://www.applemust.com/with-savings-apple-has-actually-built-a-magic-money-tree/