(Bloomberg) — European Central Bank officials weighing whether they’ve raised borrowing costs far enough are confronting a related challenge: how to ensure their policy continues to work.

Most Read from Bloomberg

President Christine Lagarde and her colleagues are looking to revamp the plumbing that connects the ECB with banks, 15 years since the collapse of Lehman Brothers marked the dawn of an era of unconventional liquidity tools — and ultimately quantitative easing.

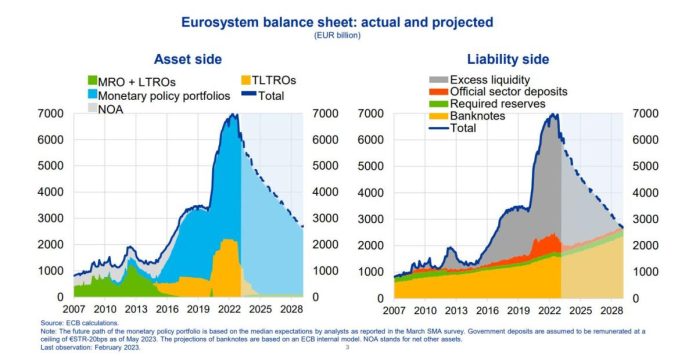

Officials can’t turn back the clock and just recreate the money-market system of the past. But without an overhaul, the ECB’s unwinding of bond holdings and long-term loans currently totaling €5.3 trillion ($5.6 trillion) could ultimately distort the monetary-policy mechanisms it uses to battle inflation.

Solutions attempted by other central banks offer some inspiration, but there’s no straightforward template. So ECB officials, having taken a close-run decision in September to raise rates again, are having to do some hard thinking on the whole functioning of their monetary framework.

“This is not a trivial issue,” Lagarde told lawmakers last month, adding that it “will inform us on the most appropriate size of the balance sheet.”

Policymakers want staff to devise ideas rethinking the ECB’s connection with the financial system, and by extension, the economy itself. Lagarde has pledged results in early 2024. Here’s a closer look at the challenge.

Balance Sheet

Officials’ key priority is to shrink a balance sheet that has swelled in the years since the global financial crisis in 2008, a process that will assist monetary tightening and create room for potential purchases in case of future crises.

Story continues

That would also put the ECB on a path toward potentially reverting to the framework that existed before years of large-scale liquidity operations and bond purchases entangled them with government finances and changed the backdrop for banks.

But slimming down the balance sheet effectively means weaning the financial system off abundant central-bank liquidity. That isn’t easy, because it’s what institutions have got used to. So officials need to work how to ensure smooth functioning and avoid shock waves.

Feeding the Banks

When the ECB started offering unlimited liquidity to all banks in 2008, that was the beginning of the end to a world where they loaned money to each other rather than relying on the central bank, and where policymakers tightly controlled the amount of money in the system to guide market rates within a corridor. Large-scale bond purchases then shut down that system for good.

Ultimately, many officials dream of recreating the pre-crisis environment, though they also worry that institutions may have lost the know-how to operate in it.

Policymakers have themselves lost visibility. They would want to know what funds the banking system needs, but there’s no easy way to tell. Demand is certainly higher than it used to be because of stricter regulation and a preference for extra buffers. The likely introduction of a digital euro — though years away — will have implications as well.

A paper commissioned by the ECB estimates banks would need reserves of about €1.4 trillion to keep the system humming. Bloomberg Economics judges that the monetary base should be between €1.8 trillion and €2 trillion.

Liquidity Tap

The current framework force-feeds liquidity into the financial system and sets a floor for borrowing costs — a lower limit — rather than trying to steer rates with an upper bound too, in a system known as a corridor.

This supply-driven approach can’t ensure that abundant cash is spread evenly across every corner of the currency union, meaning funding squeezes can’t be ruled out.

ECB officials are studying whether this is still optimal. The Federal Reserve has committed to keeping a similar such framework, but that means nursing a permanently bigger balance sheet.

The UK Approach

Some officials including ECB Executive Board member Isabel Schnabel are keen to transition to a model similar to the Bank of England’s demand-led approach, which also steers rates using a floor.

While the UK central bank has a bond portfolio too, its framework relies on banks borrowing the money they actually need.

Since funds are provided at a rate that matches the BOE’s deposit rate, there’s no price to erring on the side of borrowing too much.

The system allows for a leaner balance sheet than the Fed’s — without risking a liquidity squeeze or uneven reserves. One advantage for the ECB would be that this could free up high-quality collateral to get back into the market.

It also lets policymakers learn from banks’ behavior and get better at estimating funding needs — a possible gateway to recreating the tight-money system of the past.

But emulating it would require some changes. While the ECB already has the setup needed to loan banks money, officials would need to eliminate the spread between the rates at which they lend and accept cash overnight, or to permanently offer loans at a cost equal to the deposit rate, just as the BOE does.

That would go some way to convince banks that tapping it won’t be seen as a sign of weakness.

Revisiting 2008

If the ECB ultimately wants to recreate the pre-crisis system, it would have to limit the amount of money supplied to the region’s banks. In that case, with less funds freely available, overnight market rates would rise because banks will pay ever higher interest for increasingly scarce liquidity.

That would reestablish the main refinancing rate — the rate at which banks can borrow from it — as the benchmark. Its two other existing rates — the deposit rate and the marginal lending rate — would serve as the roof and ceiling in that corridor.

“I have some nostalgia for the corridor,” said Francesco Papadia, who ran ECB market operations from 1998 until 2012, and is now a senior fellow at the Bruegel Institute in Brussels. “It could be this comes out again as the situation we want to be in. But I’m not committal at this stage.”

Sweden’s Riksbank has attempted to fast-track the creation of a rate corridor by absorbing excess funds within the banking system, but that’s still a work in progress.

Officials are struggling to attract enough demand, and as a result the market benchmark remains tightly linked to the lower deposit rate rather than the Riksbank’s official policy rate.

Such a corridor system also isn’t easily compatible with the resumption of quantitative easing in a future crisis because the creation of excess liquidity would push borrowing costs back to the floor.

Work in Progress

Whatever ECB policymakers decide, the clock is ticking. Of the ECB’s €4.8 trillion in bond holdings, some €333 billion — about 7% — will roll off the balance sheet through next September. Another €491 billion of targeted long-term loans will expire by the end of 2024.

“Expectations are that we will get back to something like a normal balance sheet maybe in 2028 or 2029,” Papadia said. “Until then, there’s not much chance to have something different from the floor approach. I believe the question about the optimal framework can be definitely answered only in the future, but it is good to start discussing it.”

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

finance.yahoo.com

https://finance.yahoo.com/news/ecb-5-3-trillion-challenge-040000777.html