Hispanolist/E+ via Getty Images

investment thesis

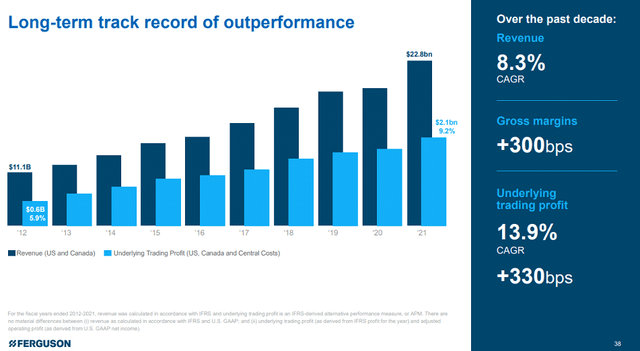

Ferguson plc (NYSE:FERG) is a leading company with a dominant share of the US plumbing and heating market. The company has demonstrated healthy sales growth and strong margins in a variety of markets over the past few years Cycles. FERG offers a wide range of products and value-added solutions for multiple customer categories in the residential, non-residential, and repair & remodeling sectors. Given FERG’s impressive track record of outperforming the market and maintaining stable margins, I believe FERG’s current value, which is higher than most of its industrial distribution peers, is still justified.

FERG Investor Relations

Diverse growth strategy

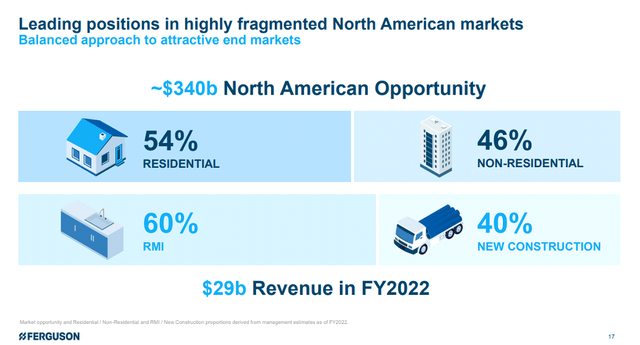

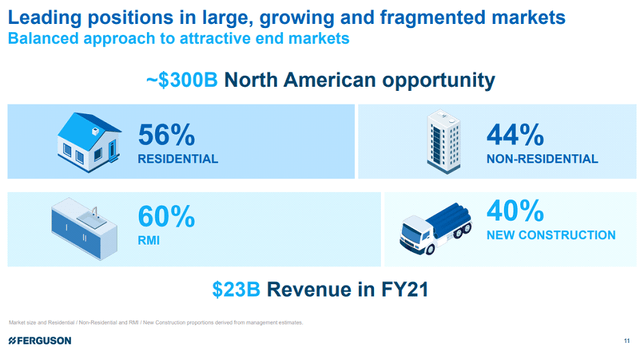

I expect FERG’s core markets to continue to contribute moderate to moderate revenue growth through a combination of gaining market share through value-added services, expanding into new markets and product lines, and pursuing strategic acquisitions. The long-term goal of FERG The goal is to achieve high single-digit organic growth that exceeds the market’s forecast growth rate of 3-5%. Additionally, FERG expects continued low single digit growth from its acquisitions, which offers further upside compared to current forecasts, which only include announced acquisitions.

FERG operates primarily in the United States and believes FERG benefits from favorable exposure to both the residential and non-residential sectors. While the growth strategy is primarily focused on improving supply chain capabilities for existing customers, it’s worth noting that FERG operates in markets where there are numerous opportunities to gain additional market share. FERG’s success is evident as 75% of its revenue comes from leading positions in the top one or two market segments, with operations significantly larger than those of smaller competitors.

FERG Investor Relations

Strong stock position but room for growth

FERG’s significant market presence is expected to result in further market share gains due to its large-scale operations, which provide customers with benefits such as extensive product availability, efficient sourcing and reliable delivery. It’s important to note that while FERG already holds a significant share in various categories, the company still has significant potential to expand its presence in each industry. This is particularly evident in the waterworks sector, where FERG currently only holds a market share of around 26%, which leaves room for further growth.

While many public distributors have recently seen market share gains in favor of larger suppliers due to supply shortages, FERG has steadily gained market share over the past several years through both mergers and acquisitions and organic growth. Although FERG already has a market-leading position, FERG’s share of its total addressable market suggests that there are significant untapped growth opportunities. As such, I expect FERG will continue to post gains in the stock, albeit at a pace more in line with historical trends.

FERG Investor Relations

Robust supply chain network strengthens FERG’s market position

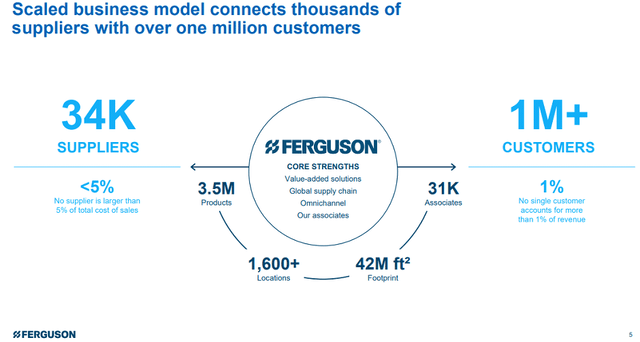

FERG has established an extensive distribution network covering the United States and Canada. With a fleet of around 5,300 vehicles, the company can efficiently serve over 95% of the US population within two days. Operations include 11 distribution centers, over 1,600 stores and nearly 250 showrooms. To support its operations, FERG relies on a large workforce of 31,000 employees.

As a key player in its vast network, FERG offers added value by delivering comprehensive solution packages in a minimal number of shipments. The company simplifies the supply chain for customers and suppliers by managing millions of stockkeeping units (SKUs) across multiple delivery channels. This positions FERG as an essential presence in the supply chain, solidifying its role as a key distributor for existing customers and laying a strong foundation for future growth and increased market share.

FERG actively invests capital in modernizing and expanding its distribution facilities. These new facilities, known as Market Distribution Centers (MDCs), are highly automated warehouses that can operate around the clock. Approximately 75% of the product selection processes in these MDCs are fully automated. Implementing MDCs brings significant productivity gains with a relatively short payback period. These MDCs contribute to reduced operational overhead due to their reduced labor and footprint. This is particularly important given the recent challenges in the labor market and the company’s commitment to the sustainable use of resources. The advanced capabilities of these facilities enhance FERG’s already mature supply chain operations and enable the company to accelerate its growth into the next phase. MDCs’ automation-driven productivity is expected to result in both organic market share gains and improved profit margins.

FERG Investor Relations

Finance: Private label products lead to an increase in margins

I believe FERG’s focus on developing its private label capabilities will play an important role in driving margin growth going forward. As the company expands its private label platform, I expect gross margin to increase significantly as these offerings make up a larger portion of its sales. It’s worth noting that private label products typically have about double the margin compared to branded items and are expected to see faster growth. FERG achieves this by working with selected manufacturers to produce specific product lines under its own brands. Through this partnership, FERG provides expertise on cost reduction strategies, rationalization initiatives and overall efficiency gains to support the manufacturer’s production process. Both parties benefit from the resulting lower cost structure without compromising their pricing power and share the profit increases.

FERG Investor Relations

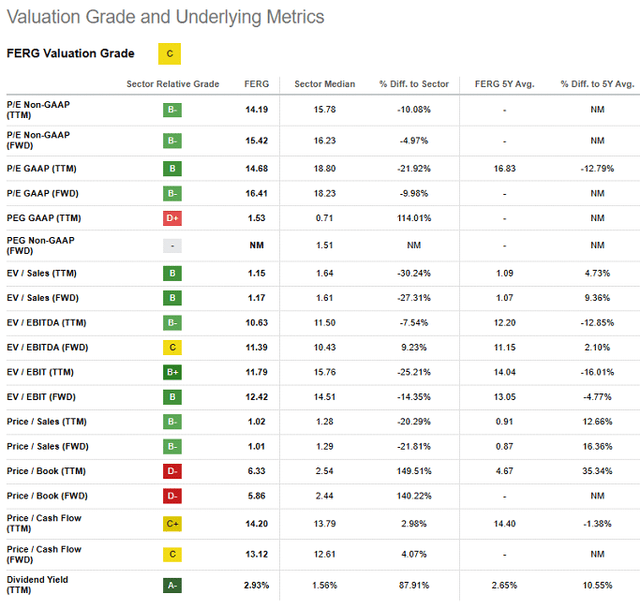

Evaluation

I believe that FERG should act in unison with other industrial distributors. In my view, investors prefer high-quality names in the uncertain economy, and FERG falls into this category with its balanced end markets and long track record of above-market growth. FERG’s market-leading positions and programmatic mergers and acquisitions to fuel incremental growth should provide investors with some comfort, while what appears to be an ongoing tight supply chain backdrop will bring FERG further benefits in the form of inflationary tailwinds to sales and margins, as well as incremental stock gains at scale for the industry player. To calculate the fair value of $168, I took a target multiple of 18x and applied it to the 2024 EPS estimate of $9.34.

I’m looking for Alpha

risks

FERG’s key advantage over its competitors is its unparalleled scale, which sets it apart in the distribution industry. While smaller competitors are making consolidation efforts to increase their market share, FERG maintains dominant positions in several categories, holding either first or second market positions. With a fully integrated system spanning over 1,600 stores and 11 distribution centers, FERG is well positioned to meet the potential challenges of these consolidations. While this could pose a longer-term risk, FERG has the resources, technological capabilities, access to capital and current market position to avoid a material stock loss.

In addition, the real estate market is vulnerable to fluctuations in interest rates, which can affect demand and therefore the associated end markets. Around 20% of FERG’s annual sales come from new residential projects. However, given FERG’s balanced portfolio between residential and non-residential end markets, as well as its diversification between new construction and repair, maintenance and improvement (RMI) segments, the company is expected to effectively navigate the current environment of rising interest rates. Additionally, the majority of FERG’s revenue comes from non-residential end markets, further stabilizing the company’s business prospects.

Diploma

FERG is a premier company that holds strong market positions in the US plumbing and heating sector. The company has steadily gained market share and experienced steady growth. FERG has a strong track record of both organic and acquisitive growth. The company’s leading scale and value-added capability enables above-market organic growth, supported by a regular M&A strategy and cost initiatives for long-term margin improvement. FERG maintains a balanced exposure to different markets, and I think the company’s strong track record of above-market growth and stable margin profile would be a catalyst for upside growth. Therefore, I recommend a Buy rating for FERG shares at the current level.

seekingalpha.com

https://seekingalpha.com/article/4604453-ferguson-leading-us-plumbing-and-heating-markets-with-strong-growth?source=content_type%3Areact%7Cfirst_level_url%3Ahome%7Csection%3Alatest_articles%7Csection_asset%3Astock_ideas%7Cline%3A1