Founded in 1938 and based in Ohio, Owens Corning is today a global building and construction materials leader with operations in 31 countries, and approximately 19,000 employees. The company develops, manufactures, and markets insulation, roofing, and fiberglass composites. Part of the Fortune 500® company for 69 consecutive years, the company aims to develop solutions that save energy and improve comfort in commercial and residential buildings.

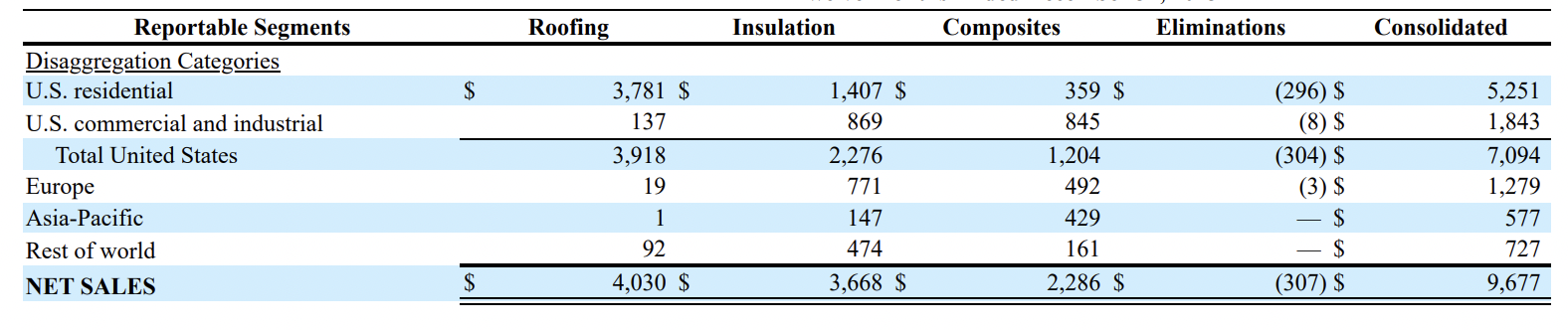

The company’s operations are segmented into three main areas: roofing, which accounts for 40.4% of net sales; insulation, making up 36.7%; and Composites, representing 22.9%.

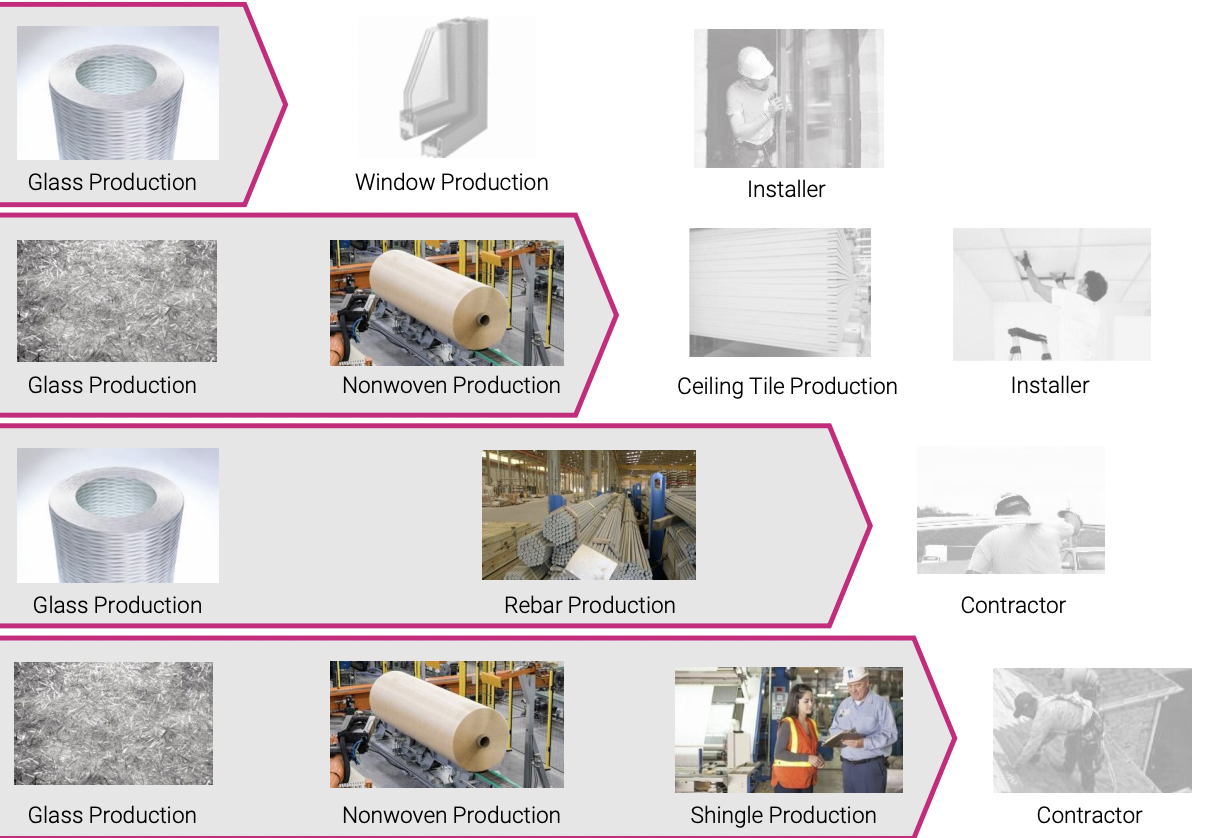

Roofing: It’s the second largest producer of asphalt roofing shingles in the United States, offers laminate and strip shingles. These products are distributed mainly through distributors, home centers, and lumberyards. The cost of oxidized asphalt, crucial for producing these shingles, is closely tied to crude oil prices, influencing both production costs and sales prices.

Insulation: It focuses on enhancing energy efficiency, thermal insulation, and acoustical performance across a variety of applications. Their range encompasses products for both residential and commercial markets, including thermal batts, loosefill, spray foam, and foam sheathing in North America, as well as specialized items like glass fiber pipe insulation and foam insulation for construction globally.

Composites: It’s a global leader in glass fiber reinforcement production, serves over 40,000 applications across building and construction, renewable energy, and infrastructure markets. Their wide array of uses includes building components, roofing materials, and renewable energy structures like wind turbine blades. The company manufactures and distributes its products worldwide. The primary markets for composites include the Building & Construction sector, the Renewable Energy industry, and Infrastructure projects.

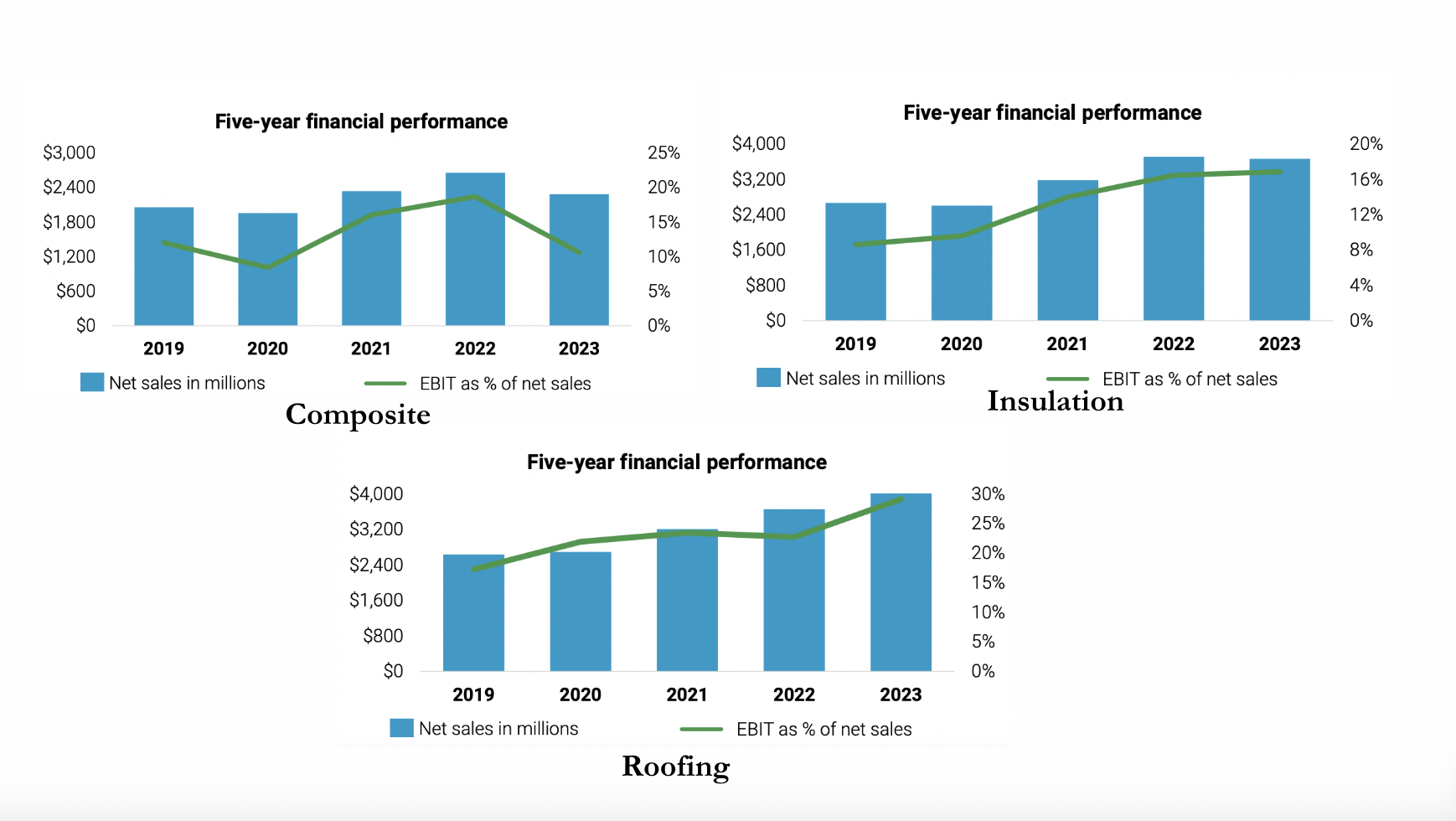

Roofing net sales increased 10% to $4.0 billion in 2023 compared to 2022, with strong YoY demand driven primarily by higher levels of storm activity, in addition to positive price and favorable mix. EBIT increased $343 million to $1.2 billion, with 29% EBIT margins and 31% EBITDA margins. The EBIT improvement was primarily due to positive price, favorable input costs and delivery, higher volumes, and favorable mix for the full year.

Insulation net sales decreased slightly to $3.7 billion in 2023 compared to 2022, primarily due to lower sales volumes in both the North American residential insulation and technical and global insulation businesses, which were largely offset by positive price, favorable delivery costs, and mix. EBIT increased $7 million to $619 million, with 17% EBIT margins and 23% EBITDA margins, with positive price and favorable mix more than offsetting the impact of lower volumes, input cost inflation, higher manufacturing costs, and planned maintenance downtime and production investments.

Composites net sales decreased 14% to $2.3 billion in 2023, primarily due to lower volumes and the net impact of divestitures and acquisitions. EBIT decreased $256 million to $242 million while delivering 11% EBIT margins and 18% EBITDA margins. The EBIT decline was driven by lower demand, primarily in glass reinforcements, the associated production downtime actions the company took throughout the year to balance inventories, and the net impact of divestitures and acquisitions. Input costs were inflationary for the year, largely offset by favorable delivery costs.

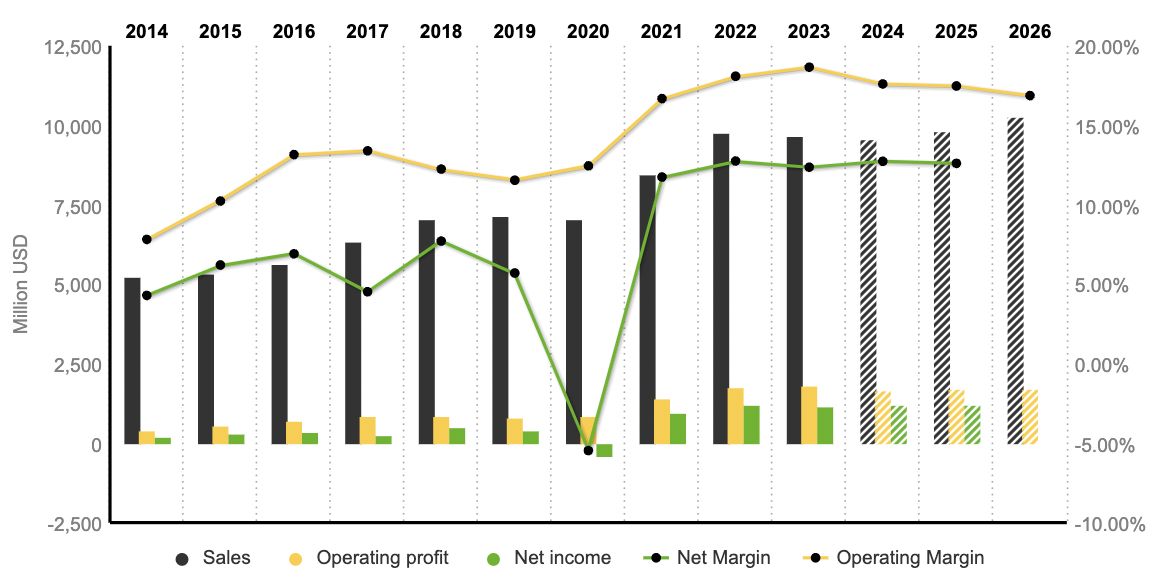

During 2023, Owens Corning resulted in $1.2B of FCF and returned $812 million to shareholders through dividends ($188M) and share repurchases ($624M).

The company’s revenue distribution is significant, with the US generating 73.1% of total revenues. Europe contributes 13.3%, Asia-Pacific 6%, and the rest of the world accounts for 7.6%. Notably, Roofing, the primary revenue segment, earns 97.2% of its revenues from the US, indicating substantial potential for international growth. Asia-Pacific presents a promising opportunity for expansion. Despite facing high competition, the company has the potential to increase its market share in this region. This opportunity is especially relevant given Asia-Pacific’s susceptibility to natural disasters, such as storms, which aligns well with the company’s offerings.

Owens Corning, like any other company, faces several risks tied to fluctuating construction activity levels in residential, commercial, and industrial sectors. These activities are cyclical and heavily influenced by economic conditions such as interest rates (increasing in 2022 & 2023), financing availability, inflation, employment, and consumer spending. Additionally, increased costs or limited availability of raw materials and transportation could negatively affect their profit margins and overall financial health.

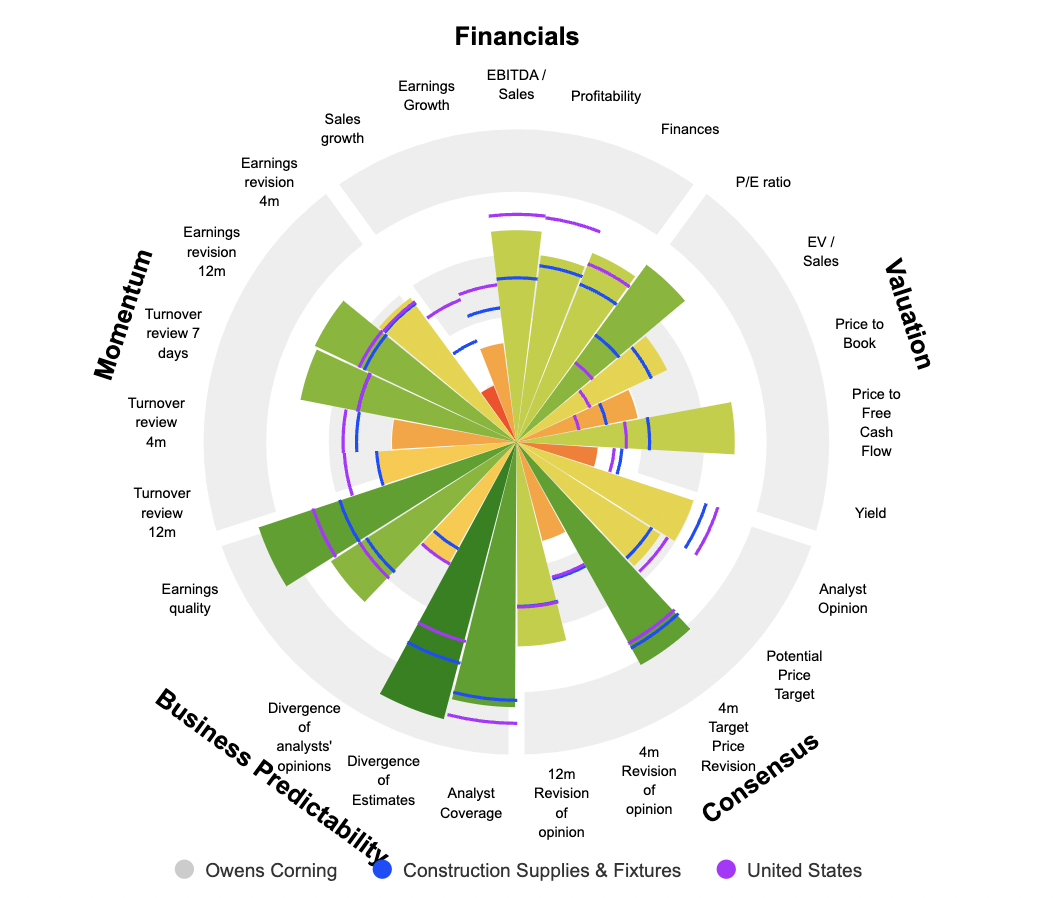

The company’s financial foundation is stable, showing modest increases in sales, net and operating margins, along with a favorable P/E ratio of 11.3x for fiscal 2023, which is below its 9-year average of 15.7x. Looking ahead, the business will be influenced by factors such as residential repair and remodeling activity, U.S. housing starts, and construction activities both in the commercial sector globally and in industrial production. Despite the effect of high interest rates on global economic growth, the company anticipates stability in most of its building and construction markets in the near term.

www.marketscreener.com

https://www.marketscreener.com/quote/stock/OWENS-CORNING-35353/news/Owens-Corning-A-champion-of-Roofing-Insulation-46247056/