Fintel reports that on May 3, 2023, Needham reiterated coverage of LendingTree (NASDAQ:TREE) with a Obtain Recommendation.

Analyst price prediction suggests 135.19% up

On April 24, 2023, the average one-year price target for LendingTree is 41.18. Forecasts range from a low of $34.34 to a high of $50.40. The average target price represents a 135.19% increase from the last reported close of 17.51.

Check out our ranking of companies with the biggest price target upside.

Projected annual revenue for LendingTree is 1,005 million, an increase of 11.38%. Projected annual non-GAAP EPS is 1.27.

How is the fund sentiment?

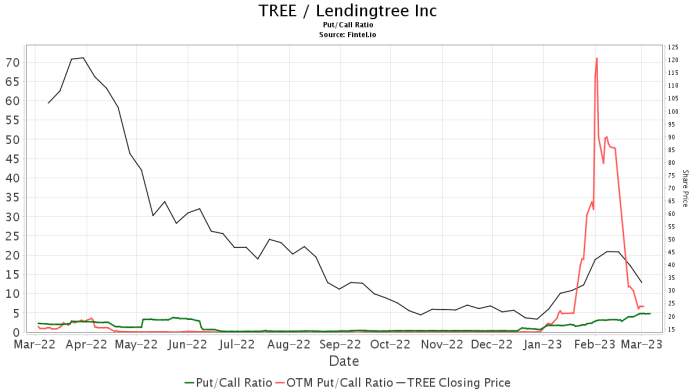

There are 376 funds or institutions reporting positions in LendingTree. That’s down 16 owners, or 4.08%, over the most recent quarter. Average portfolio weight all funds TREE dedicated is 0.05%, an increase of 13.01%. The total number of shares held by institutions fell 5.49% over the past three months to 11,501,000 shares. TREE’s put/call ratio is 2.02, indicating a bearish outlook.

What are other shareholders doing?

IJR – iShares Core S&P Small-Cap ETF holds 816,000 shares which represents 6.37% of shares in the company. In its earlier filing, the company said it owned 793,000 shares, which this represents A rise of 2.88%. The Company reduced its portfolio allocation to TREE increased by 16.26% in the most recent quarter.

Baillie Gifford holds 561,000 shares, representing a 4.38% stake in the company. In its earlier filing, the company said it owned 564,000 shares, which this represents acceptance of 0.50%. The Company reduced its portfolio allocation to TREE increased by 59.81% in the most recent quarter.

Granahan Investment Management holds 409,000 shares representing a 3.19% stake in the company. In its earlier filing, the company said it owned 554,000 shares, which this represents acceptance of 35.50%. The Company reduced its portfolio allocation to TREE increased by 38.22% in the most recent quarter.

Jacobs Levy Equity Management holds 349,000 shares representing a 2.72% interest in the company. In its earlier filing, the company said it owned 218,000 shares, which this represents A rise of 37.57%. The Company elevated its portfolio allocation to TREE increased by 22.56% in the most recent quarter.

DE Shaw holds 348,000 shares, representing a 2.71% stake in the company. In its earlier filing, the company said it owned 244,000 shares, which this represents A rise of 29.81%. The Company elevated its portfolio allocation to TREE increased by 17.88% in the most recent quarter.

LendingTree background information

(This description is provided by the company.)

LendingTree is the nation’s leading online marketplace, connecting consumers with the choices they need to be confident in their financial decisions. LendingTree enables consumers to buy financial services the same way they buy airline tickets or hotel stays, compare multiple offers from a nationwide network of over 500 partners in one simple search, and choose the option that best suits their financial needs. Services include mortgage loans, mortgage refinance, auto loans, personal loans, business loans, student loans, insurance, credit cards and more. Through the My LendingTree platform, consumers receive free credit scores, credit monitoring, and credit improvement recommendations. My LendingTree proactively compares consumers’ credit accounts to offers on its network and notifies consumers when there is an opportunity to save money. In short, the purpose of LendingTree is to simplify financial decisions for life’s meaningful moments through choice, education and support. LendingTree, LLC is a subsidiary of LendingTree, Inc.

View all of LendingTree’s regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com

https://www.nasdaq.com/articles/needham-reiterates-lendingtree-tree-buy-recommendation