Fintel reports that on May 24, 2023, Barclays ceased coverage of Victorian Plumbing Group (LON:VIC) with a overweight Recommendation.

Analysts’ price forecast points to an upside potential of 40.00%

As of May 11, 2023, the average one-year price target for the Victorian Plumbing Group is 109.48. Forecasts range from a low of $92.92 to a high of $138.60. The average target price represents a 40.00% increase from the last reported close of 78.20.

Check out our ranking of companies with the biggest price target upside.

The forecast annual turnover of the Victorian Plumbing Group is 297 million, an increase of 5.06%. Projected annual non-GAAP EPS is 0.05.

The Victorian Plumbing Group maintains a dividend yield of 1.41%

At the most recent price, the company’s dividend yield is 1.41%.

Additionally, the company’s dividend payout ratio is 0.31. The payout ratio indicates how much of a company’s income is paid out as a dividend. A payout ratio of one (1.0) means that 100% of the company’s income is paid out as a dividend. A payout ratio greater than one means the company is drawing on savings to maintain its dividend — not a healthy situation. Companies with low growth prospects are expected to pay out the majority of their income in the form of dividends, which typically equates to a payout ratio of between 0.5 and 1.0. Companies with good growth prospects are expected to retain a portion of their earnings to invest in those growth prospects, which equates to a payout ratio of zero to 0.5.

For a list of the companies with the highest dividend yields, see Fintel’s Dividend Screener.

How is the fund sentiment?

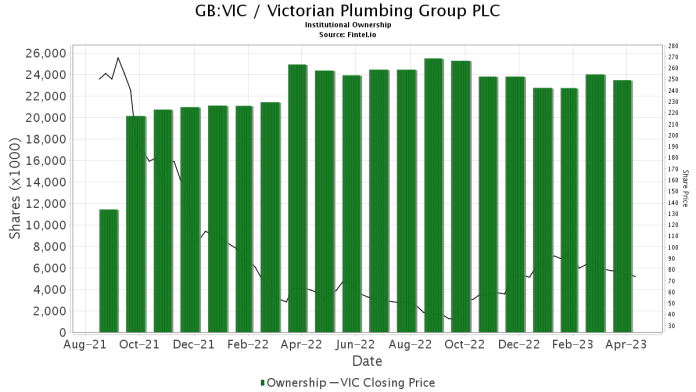

There are 15 funds or institutions reporting holdings in the Victorian Plumbing Group. This is an increase of 2 owners or 15.38% over the last quarter. Average portfolio weight all funds The stake earmarked for VIC is 0.34%, an increase of 109.21%. The total number of shares held by institutions rose 3.39% over the past three months to 23,475,000 shares.

What are other shareholders doing?

VISAX – Virtus KAR International Small-Cap Fund holds 10,747,000 shares which is 3.30% stake in the company. No change in the last quarter.

PRIDX – The T. Rowe Price International Discovery Fund holds 7,407,000 shares representing a 2.28% interest in the company. No change in the last quarter.

NAINX – VIRTUS TACTICAL ALLOCATION FUND holds 1,405,000 shares representing a 0.43% stake in the company. No change in the last quarter.

WIGTX – The Seven Canyons World Innovators Fund institutional class holds 1,147,000 shares, representing a 0.35% interest in the company.

The GPGOX – Grandeur Peak Global Opportunities Fund investor class holds 1,040,000 shares representing a 0.32% stake in the company. No change in the last quarter.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com

https://www.nasdaq.com/articles/barclays-reiterates-victorian-plumbing-group-lon:vic-overweight-recommendation